Requirements for parental allowance

Requirements for parental allowance

Parental allowance replaces part of your lost income if you want to be there for your child after the birth and work less or not at all for a while. Perhaps you are wondering when you can receive parental allowance? Can you receive parental allowance if you continue to work? Or if you haven't worked at all? What special features are there for single parents and for parents without German citizenship? Here you will find answers to the most important questions about the requirements for receiving parental allowance.

When can I receive parental allowance?

You can receive parental allowance if you meet the following requirements:

- You look after and raise your child yourself.

- You live with your child in a shared household.

- You and your child live in Germany.

- You do not work more than 32 hours per week while you are receiving parental allowance.

If you come from another European Union (EU) country or from Iceland, Liechtenstein, Norway or Switzerland, you can generally receive parental allowance in Germany if you live or work here.

If you meet all these requirements, you can apply for parental allowance.

What income limits must be observed?

- For children born on or after April 1, 2025, an income limit of 175,000 euros applies for couples and single parents. If you exceed this income limit, you cannot receive parental allowance.

- For couples whose child was born by March 31, 2025, the limit for taxable income is 200,000 euros. The same income limit applies to single people.

- The decisive factor is the taxable income in the calendar year prior to the birth of the child.

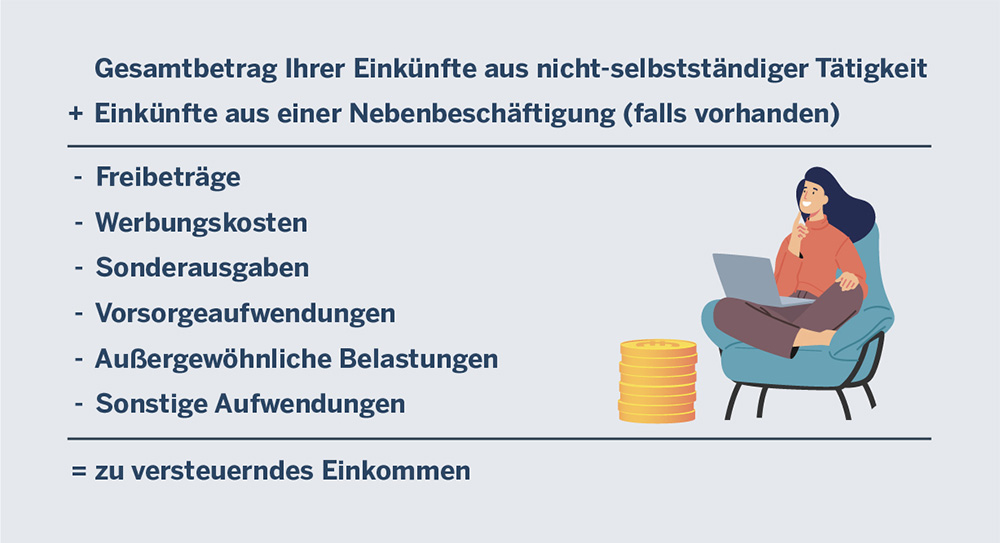

How do I calculate my taxable income?

To determine your taxable annual income, you can deduct the following amounts from your gross salary:

The taxable income is therefore always lower than your gross income.

Your individual taxable income is calculated by the tax office. You can find the amount in your tax return.